Welcome to Landmark Cash ™. To expedite the borrowing process click the apply button in the navigation menu. If you would like to learn more about payday loan companies and lending rates please browse our website.

Payday Loans Online at Landmark Cash ™

It is completely secure to apply for payday loans online at Landmark Cash ™. Completing an application is only an inquiry, and you are not obligated to accept the offer unless you are satisfied with the terms.

It is completely secure to apply for payday loans online at Landmark Cash ™. Completing an application is only an inquiry, and you are not obligated to accept the offer unless you are satisfied with the terms.

After completing an application, your details are instantly sent to a secure server and reviewed within 24 hours. The Truth in Lending Act was created to protect you the consumer and requires all lenders to disclose the amount and any fees before you accept the terms.

To qualify you need to be 18yrs or older, employed for 90 days and take home a minimum of 1,000 dollars per month. Please keep in mind these are the minimum requirements and meeting them does not guarantee you will be approved for legitimate payday loans online. Direct cash loans are not available in all states which include but is not limited to New York.

There are no restrictions on how you can use bad credit loans, but please remember to borrow responsibly. You will be expected to repay your debt on time to avoid incurring any extra interest or penalties. The interest rate of same day loans is higher than you would get from a bank. We recommend you use check advances as short-term financing for immediate cash needs.

Loan amounts will vary between direct payday lenders and depend on your financial history. Typically your credit score is not a factor, but each lender has unique requirements which are why we work with over 70 different legit payday loan companies. We don't offer guaranteed payday loans but our unique proprietary pairing system can significantly increase your chances of securing cash advance loans on the internet.

Landmark Cash ™ is the best online payday loans for bad credit referral company. After you submit your application, we will automatically connect you with a pool of direct payday loan lenders that cater to people with bad credit. Upon approval, you will receive with the exact terms and conditions of your loan.

Landmark Cash ™ is considered an expert in the financial services field. We work with and comply with all Consumer Financial Protection Bureau (CFPB), Community Financial Services Association of America (CFSA), Federal Trade Commission (FTC) and Online Lenders Alliance (OLA) regulations.

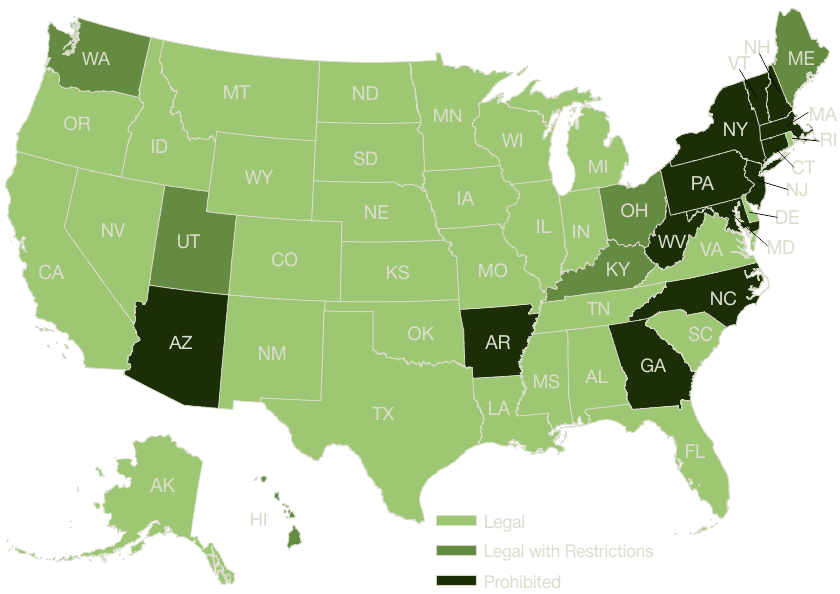

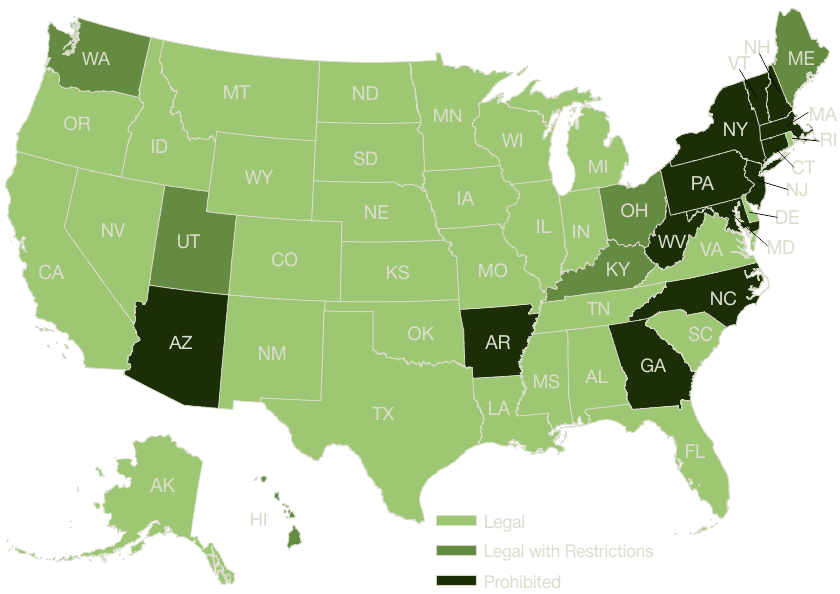

Which States Allow Payday Loans?

Some states allow cheap payday loans while others do not. Below is a map of the United States which displays each states' stance on short-term lending. Landmark Cash ™ does its best to keep the information below accurate, but please perform your due diligence.

IMPORTANT: If cash advances are not legal in your state, you CAN still apply. You will not be approved, but there may be alternative funding options available.

List of States Where Payday Loans Are Legal Online

Landmark Cash ™ will do its best to keep each states terms up to date. States can change their terms without notice, and by viewing this data, you agree not to hold Landmark Cash ™ liable for any discrepancies.

| State |

Allowed |

Maximum Amount |

Length |

| Alabama (AL) |

Yes |

$500 |

31 days |

| Alaska (AK) |

Yes |

$500 |

14 days |

| Arizona (AZ) |

No |

|

|

| Arkansas (AR) |

No |

|

|

| California (CA) |

Yes |

$300 |

31 days |

| Colorado (CO) |

Yes |

$500 |

No maximum |

| Connecticut (CT) |

No |

|

|

| Delaware (DE) |

Yes |

$500 |

60 days |

| District of Columbia (DC) |

No |

|

|

| Florida (FL) |

Yes |

$500 |

31 days |

| Georgia (GA) |

No |

|

|

| Guam (GU) |

No |

|

|

| Hawaii (HI) |

Yes |

$600 |

32 days |

| Idaho (ID) |

Yes |

$1,000 |

No maximum |

| Illinois (IL) |

Yes |

$1,000 |

120 days |

| Indiana (IN) |

Yes |

$550 |

No maximum |

| Iowa (IA) |

Yes |

$500 |

31 days |

| Kansas (KS) |

Yes |

$500 |

30 days |

| Kentucky (KY) |

Yes |

$500 |

60 days |

| Louisiana (LA) |

Yes |

$350 |

30 days |

| Maine (ME) |

No |

|

|

| Maryland (MD) |

No |

|

|

| Massachusetts (MA) |

No |

|

|

| Michigan (MI) |

Yes |

$600 |

31 days |

| Minnesota (MN) |

Yes |

$350 |

30 days |

| Mississippi (MS) |

Yes |

$500 |

30 days |

| Missouri (MO) |

Yes |

$500 |

31 days |

| Montana (MT) |

Yes |

$300 |

No maximum |

| Nebraska (NE) |

Yes |

$500 |

34 days |

| Nevada (NV) |

Yes |

No maximum |

No maximum |

| New Hampshire (NH) |

Yes |

$500 |

30 days |

| New Jersey (NJ) |

No |

|

|

| New Mexico (NM) |

Yes |

$2,500 |

35 days |

| New York (NY) |

No |

|

|

| North Carolina (NC) |

No |

|

|

| North Dakota (ND) |

Yes |

$500 |

60 days |

| N. Mariana Islands (MP) |

No |

|

|

| Ohio (OH) |

Yes |

$1000 |

No maximum |

| Oklahoma (OK) |

Yes |

$500 |

45 days |

| Oregon (OR) |

Yes |

No maximum |

No maximum |

| Pennsylvania (PA) |

No |

|

|

| Puerto Rico (PR) |

No |

|

|

| Rhode Island (RI) |

Yes |

$500 |

No maximum |

| South Carolina (SC) |

Yes |

$550 |

31 days |

| South Dakota (SD) |

Yes |

$500 |

No maximum |

| Tennessee (TN) |

Yes |

$500 |

31 days |

| Texas (TX) |

Yes |

No maximum |

31 days |

| Utah (UT) |

Yes |

No maximum |

70 days |

| Vermont (VT) |

No |

|

|

| Virginia (VA) |

Yes |

$500 |

No maximum |

| Virgin Islands (VI) |

No |

|

|

| Washington (WA) |

Yes |

$700 |

45 days |

| West Virginia (WV) |

No |

|

|

| Wisconsin (WI) |

Yes |

$1,500 |

90 days |

| Wyoming (WY) |

Yes |

No maximum |

One calendar month |

Most Frequently Asked Questions

We receive hundreds of emails per day from customers with questions. Below we have listed the most commonly asked questions and the best answer we can provide without knowing your exact situation. If your question was not covered below feel free to contact us and we will do out best to help in any way possible.

We receive hundreds of emails per day from customers with questions. Below we have listed the most commonly asked questions and the best answer we can provide without knowing your exact situation. If your question was not covered below feel free to contact us and we will do out best to help in any way possible.

How do I know if the company is a legitimate payday loan lender?

You should NEVER pay to receive a loan from actual payday lenders. If you are asked to pay any upfront fee, it is a red flag, and you should immediately stop all communication with the individual. Legitimate businesses will have a physical address, phone number and email address that's readily available.

Are there payday loans online without running your credit?

Every lender reserves the right to run your credit at their discretion. The first step a creditor takes is to run your name through a database to see if you have any outstanding debt. If the lender finds you currently have debt, there is a chance a credit check will be performed. In most cases, applicants have bad credit, so a credit inquiry will not hurt your chances of being approved. There are some lenders who offer legitimate payday loans online no credit check but this is not a common occurrence.

Can you get a loan with no credit history?

The short answer is yes, but it will not be easy. When it comes to credit history, there is a big difference between no credit and bad credit. When you have no credit history, the lender does not have a way to establish how likely you are to repay the money you borrowed. In this scenario, your best option is to find a co-signer or put up collateral if you are applying at a bank. If you are applying, your credit history will not be relied on as heavily; more emphasis is placed on your current income and employment status.

What are payday loans?

Online payday loans may also be referred to as a cash advance, payday advance, payroll loan, salary loan or short-term loan. These loans are for people with bad to poor credit which means credit scores below 630. Loan amounts range from $100-$1500 and are paid back on the date of your next paycheck. The interest rate can be up to 300% in some states. Borrowers can secure their funds by completing an application on the companies website.

What are personal loans?

Personal loans are meant for people who have established good credit with scores above 630. The higher your credit score, the lower your interest rate will be. For example, excellent credit in the 720-850 range can expect to pay about 10% interest, good credit scores in the 690-719 range will pay about 15%, and average credit in the 631-689 will pay 20% or more. Personal loans can be obtained from banks and credit unions.

How many payday loans can you get?

There are currently 32 states that allow payday advances from $100 to $1500. When you take out a cash advance, your information will be entered into a statewide database that tracks the number of loans you have outstanding. Each state has different regulations (see chart above) which define the number of loans you can have, maximum dollar amount, associated fees and the amount of time you have to repay.

What happens if I do not pay back my loan?

Failing to repay debt is not a crime, and you can not be sent to jail. What the lender can do is sue you in civil court, and the judge may garnish your paycheck until the debt is repaid. Failure to repay your note may affect your credit score and attempts at securing money in the future.

Can you consolidate payday loans?

First, let's get a better understanding of the term consolidation. Consolidation means you take all your current debt and package it into one big loan. The problem with this is most states have a maximum dollar amount that you can borrow (see chart above) and a maximum number of loans you can have at one time. State regulations make it unlikely that you would be able to consolidate high-interest payday loans.

Where are payday loans illegal?

There are currently 18 states, Guam and the District of Columbia (DC) that prohibit high-interest lending. States that do not allow paycheck advances include Arizona, Arkansas, Connecticut, District of Columbia, Georgia, Guam, Maine, Maryland, Massachusetts, New Jersey, New York, North Carolina, N. Mariana Islands, Pennsylvania, Puerto Rico, Vermont, Virgin Islands and West Virginia.

What is a title loan on a car?

A car title loan is similar to a faxless loan, except must put up collateral which in this case is your vehicle. A title loan is still a legitimate short-term loan which is typically repaid within 30 days. The advantage of a title loan is you can borrow more than a bad credit loan if your vehicle is worth enough money. The disadvantage of a title loan is you could lose your car if you do not repay the loan.

What is the interest rate on a car title loan?

There are currently 21 states that allow car title loans. In those 21 states, there are approximately 7,728 car title lenders licensed to operate. On average a borrower will receive 27 percent of the vehicle's value with an interest rate of 300 percent. For example, if your car is worth $10,000 you would receive $2,700 and pay $8,100 in interest per year on that loan.

How can I get money without getting a loan?

- Sell personal belongings through local classifieds or pawn stores.

- Ask your employer if they offer a cash advance program.

- Withdraw money from your savings, emergency or retirement account.

- Raise funds on websites like Fiverr in exchange for providing a service.

- Ask family members or friends.

- Start your own business from home.

- Apply for a cash advance from your credit card.

Where can I go to borrow money fast?

Below is an example of places you can borrow money from and the interest rate you will pay over time. This example assumes you have average credit which is needed to be approved by credit unions and banks.

- Federal credit union average APR is 9.30%, and it will take over one week to receive your loan.

- Personal loans from a bank average APR is 15%, and it will take 1 to 10 days to receive your funds.

- Cash advance from your credit card average APR is 25%, and the funds are usually available immediately.

- Payday loan average APR is 200%, and the money is usually available immediately.

How can you get a loan with bad credit?

- Find an online lender that offers bad credit loans.

- Provide your name and social security number for identity verification.

- Provide proof of income which is usually a job or benefits.

- Provide your latest paycheck to verify income.

- Provide your checking account and routing number.

- The lender will use this information to determine your eligibility.

How can I get approved for a loan?

Many factors are taken into account when considering an applicant. Following these tips will help increase your chances of being accepted.

- Know your credit score and work towards improving it.

- Make sure you pay all your bills on time and don't have an exceedingly high debt to income ratio.

- Apply for the right type of loan. People with good credit can apply to banks and credit unions. If you have bad credit, short term lenders are a better option.

- Do your homework on the lender before you apply. Make sure the company is legitimate, offers the type of loan you need and that you meet their requirements.

How can I rebuild my bad credit?

- Pay your bills on time.

- Don't borrow more money than you can repay on time.

- Keep the balance on your credit cards low and pay them off before they are due.

- If you have old unused credit cards do not close the accounts they will help increase your credit score.

- Take out a small, low-interest loan with the goal of making every payment on time.

- Get someone with established credit to co-sign for a loan.

- Limit the number of 3 month payday loans you apply for because hard pulls hurt your credit.

It is completely secure to apply for payday loans online at Landmark Cash ™. Completing an application is only an inquiry, and you are not obligated to accept the offer unless you are satisfied with the terms.

It is completely secure to apply for payday loans online at Landmark Cash ™. Completing an application is only an inquiry, and you are not obligated to accept the offer unless you are satisfied with the terms.